Mar 2023 - It's All About That Rate

March 2023 Update

It's all about that Rate

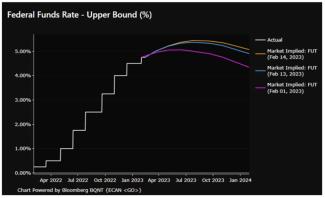

The market's expectation of interest rates is anything but stable...it's all just noise right now

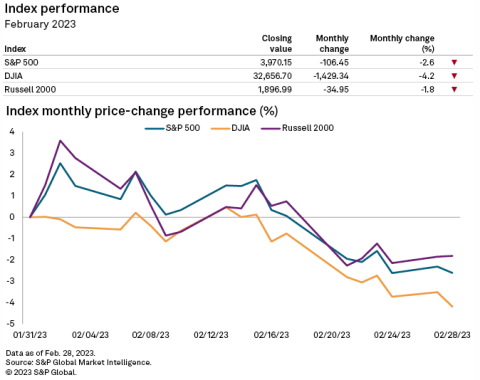

The January rally came to a halt in February, as inflation and economic data continued to come in better than expected and investors (finally?) began to appreciate that the Fed isn't in a hurry to cut interest rates. I know, I know - it makes no sense that a stubbornly good economy is somehow increasingly worrisome. But that's the fundamental driver of all the short-term market volatility of late - that, and how the Fed will react to it - and it's showing no signs of stopping.

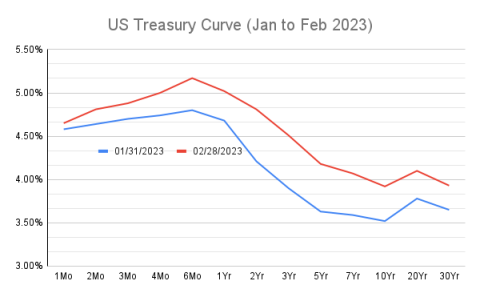

In the meantime, bond yields are reaching their highest levels in years. The increase in the Federal Funds rate has raised bond yields generally, but the specific concerns over a potential recession and slowing earnings growth have specifically pushed shorter-term bonds to even more attractive levels, relatively. The now heavily inverted US Treasury curve makes 6-month bond investments seem like a no-brainer for anyone with a short time horizon, but locking in longer term bond returns at this point is a lot less compelling.

This broad rise in interest rates has also led to higher mortgage rates, especially as the chances of a 2023 Fed rate cut continue to wane. In February alone, the 30yr fixed mortgage spiked up from ~6% to over 7%.

Everything else:

- The Biden-Harris student debt relief program may be losing steam; all we can do is wait (and prepare to continue making payments soon).

- ESG investing hit a pothole in the Senate, making it harder to consider non-financial factors in making investment decisions

- Corporate earnings growth is beginning to slow - is this a sign of more pain?

- Can housing demand recover with rates back up near 7%?

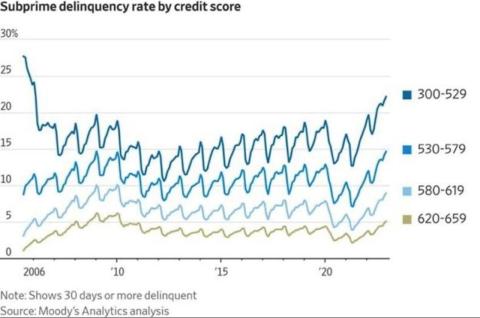

The chart above is an interesting look at subprime delinquency rates by credit score...the trend since 2021 does not bode well for the lower end of the housing market.